First published on July 22nd, 2022 by Bob Ciura for Sure Dividend

Bill Gates is the fourth-richest person in the world, behind only Jeff Bezos, Elon Musk, and Bernard Arnault. His net worth of ~$129 billion is a massive amount of money. Not surprisingly, the Bill & Melinda Gates Foundation has a huge investment portfolio above $19 billion according to a recent 13F filing.

That kind of wealth is something the vast majority of us can only dream of. However, there is one similarity between the everyday investor and the wealthiest person on the planet.

We’re all looking for good stocks to buy and hold for the long-term. That is why it is useful to review the stock holdings of the Bill & Melinda Gates Foundation.

You can download our full list of all 18 Gates Foundation stocks (along with important metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all of The Bill & Melinda Gates Trust’s individual stock holdings, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download the Gates Foundation’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

The spreadsheet above is missing the following tickers: BRK.B, MSGS, & ONON. We will add these tickers in soon.

The Bill & Melinda Gates Foundation owns several highly profitable companies, with sustainable competitive advantages. Many of the stocks also pay dividends to shareholders, and grow their dividend payouts over time.

This article will discuss the 18 stocks held by the Bill & Melinda Gates Foundation.

Table of Contents

You can skip to the analysis for each of the Gates Foundation’s 18 stock holdings, with the table of contents below. Stocks are listed in order of the portfolio’s largest positions to smallest positions.

- Berkshire Hathaway (BRK.B)

- Waste Management (WM)

- Canadian National Railway (CNI)

- Caterpillar Inc. (CAT)

- Ecolab (ECL)

- Walmart (WMT)

- Deere & Company (DE)

- Coca-Cola FEMSA, S.A.B. de C.V. (KOF)

- Microsoft (MSFT)

- Crown Castle International (CCI)

- Schrodinger, Inc. (SDGR)

- United Parcel Service, Inc. (UPS)

- FedEx Corp. (FDX)

- Coupang, Inc. (CPNG)

- Sanderson Farms, Inc. (SAFM)

- Madison Square Garden Sports Corp. (MSGS)

- Weber Inc. (WEBR)

- On Holding AG (ON)

You can also watch video analysis of Gates’ stock holdings below:https://www.youtube.com/embed/JiTgMqWWuho

#1—Berkshire Hathaway

Dividend Yield: N/A (Berkshire Hathaway does not currently pay a dividend)

Percentage of Bill Gates’ Portfolio: 51.22%

Berkshire Hathaway stock is the largest individual holding of the Gates Foundation’s investment portfolio, and it is easy to see why. It’s safe to say the money is in good hands. Berkshire, under the stewardship of Warren Buffett, grew from a struggling textile manufacturer, into one of the largest conglomerates in the world.

Today, Berkshire is a global giant. It owns and operates dozens of businesses, with a hand in nearly every major industry including insurance, railroads, energy, finance, manufacturing, and retailing. It has a market capitalization above $600 billion.

Berkshire can be thought of in five parts: wholly owned insurance subsidiaries like GEICO, General Re and Berkshire Reinsurance; wholly-owned non-insurance subsidiaries like Dairy Queen, BNSF Railway, Duracell, Fruit of the Loom, NetJets, Precision Cast Parts and See’s Candies; shared control businesses like Kraft Heinz (KHC) and Pilot Flying J; marketable publicly-traded securities including significant stakes in companies like American Express (AXP), Apple (AAPL), Bank of America (BAC), Coca-Cola (KO) and Wells Fargo (WFC); and finally the company’s cash position.

In Berkshire’s annual letters to shareholders, Buffett typically evaluates the company’s performance in terms of book value. Book value is an accounting metric that measures a company’s assets minus its liabilities. The resulting difference is a company’s book value. This is a proxy for the intrinsic value of a firm, which Buffett believes to be the most important financial metric.

Berkshire doesn’t pay a dividend to shareholders. Buffett and his partner Charlie Munger have always contended that they can create wealth at a higher rate than the dividend would provide to shareholders.

While Berkshire stock may not be attractive for investors who want dividend income, there are few companies that have a track record nearly as great as Berkshire’s.

#2—Waste Management

Dividend Yield: 1.7%

Percentage of Bill Gates’ Portfolio: 14.94%

Waste Management is the embodiment of a company with a wide economic “moat”, a term popularized by Warren Buffett to describe a strong competitive advantage that protects a company from the full ravages of market competition. Waste Management operates in waste removal and recycling services. This is a highly-concentrated industry, with only a few companies controlling the majority of the market.

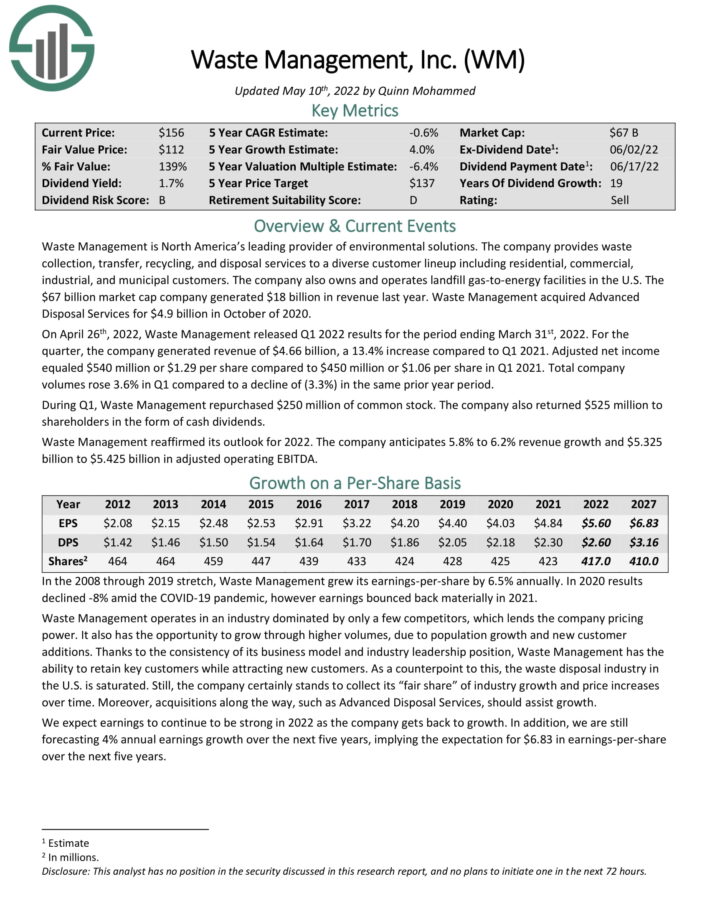

On April 26th, 2022, Waste Management released Q1 2022 results for the period ending March 31st, 2022. For the quarter, the company generated revenue of $4.66 billion, a 13.4% increase compared to Q1 2021. Adjusted net income equaled $540 million or $1.29 per share compared to $450 million or $1.06 per share in Q1 2021. Total company volumes rose 3.6% in Q1 compared to a decline of (3.3%) in the same prior year period.

During Q1, Waste Management repurchased $250 million of common stock. The company also returned $525 million to shareholders in the form of cash dividends. Waste Management reaffirmed its outlook for 2022. The company anticipates 5.8% to 6.2% revenue growth and $5.325 billion to $5.425 billion in adjusted operating EBITDA.

Click here to download our most recent Sure Analysis report on Waste Management (preview of page 1 of 3 shown below):

#3—Canadian National Railway

Dividend Yield: 1.83%

Percentage of Bill Gates’ Portfolio: 8.87%

Canadian National Railway is the only transcontinental railroad in North America. It has a network of approximately 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico. It handles over $200 billion worth of goods annually and carries over 300 million tons of cargo.

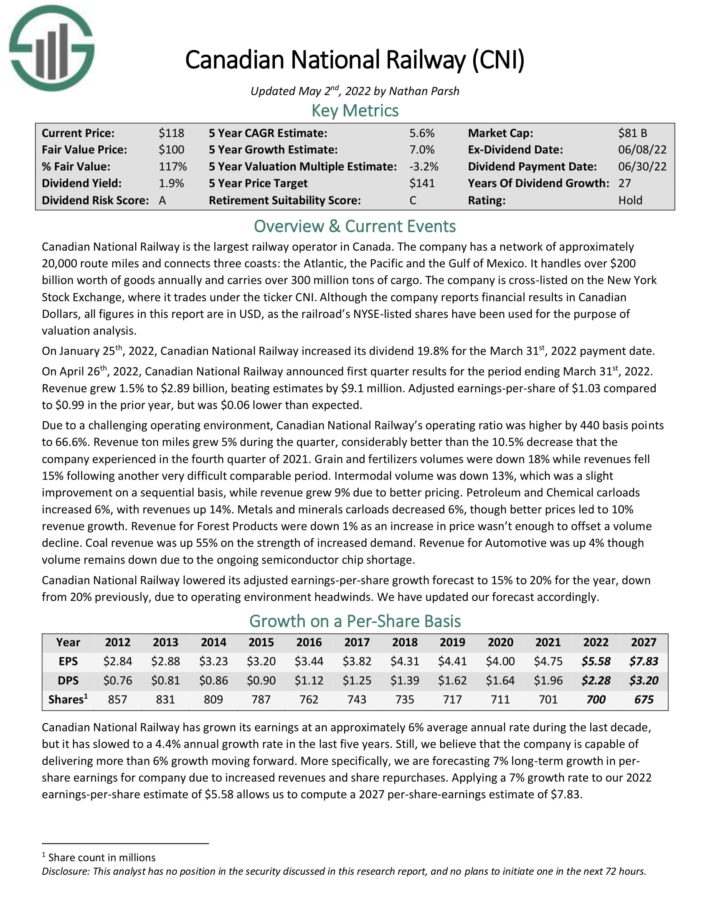

On January 25th, 2022, Canadian National Railway increased its dividend 19.8% for the March 31st, 2022 payment date.

On April 26th, 2022, Canadian National Railway announced first quarter results for the period ending March 31st, 2022. Revenue grew 1.5% to $2.89 billion, beating estimates by $9.1 million. Adjusted earnings-per-share of $1.03 compared to $0.99 in the prior year, but was $0.06 lower than expected.

Due to a challenging operating environment, Canadian National Railway’s operating ratio was higher by 440 basis points to 66.6%. Revenue ton miles grew 5% during the quarter, considerably better than the 10.5% decrease that the company experienced in the fourth quarter of 2021. Grain and fertilizers volumes were down 18% while revenues fell 15% following another very difficult comparable period.

Intermodal volume was down 13%, which was a slight improvement on a sequential basis, while revenue grew 9% due to better pricing. Petroleum and Chemical carloads increased 6%, with revenues up 14%. Metals and minerals carloads decreased 6%, though better prices led to 10% revenue growth. Revenue for Forest Products were down 1% as an increase in price wasn’t enough to offset a volume decline. Coal revenue was up 55% on the strength of increased demand.

Canadian National Railway lowered its adjusted earnings-per-share growth forecast to 15% to 20% for the year, down from 20% previously, due to operating environment headwinds.

Click here to download our most recent Sure Analysis report on Canadian National Railway (preview of page 1 of 3 shown below):

#4—Caterpillar

Dividend Yield: 2.5%

Percentage of Bill Gates’ Portfolio: 8.29%

Caterpillar is the global leader in heavy machinery. It has a strong brand with a dominant industry position. Caterpillar manufactures and markets heavy machinery, mostly for the construction and mining sectors.

The company operates in three primary segments: Construction Industries, Resource Industries and Energy & Transportation, along with ancillary financing and related services through its Financial Products segment.

Source: Investor Presentation

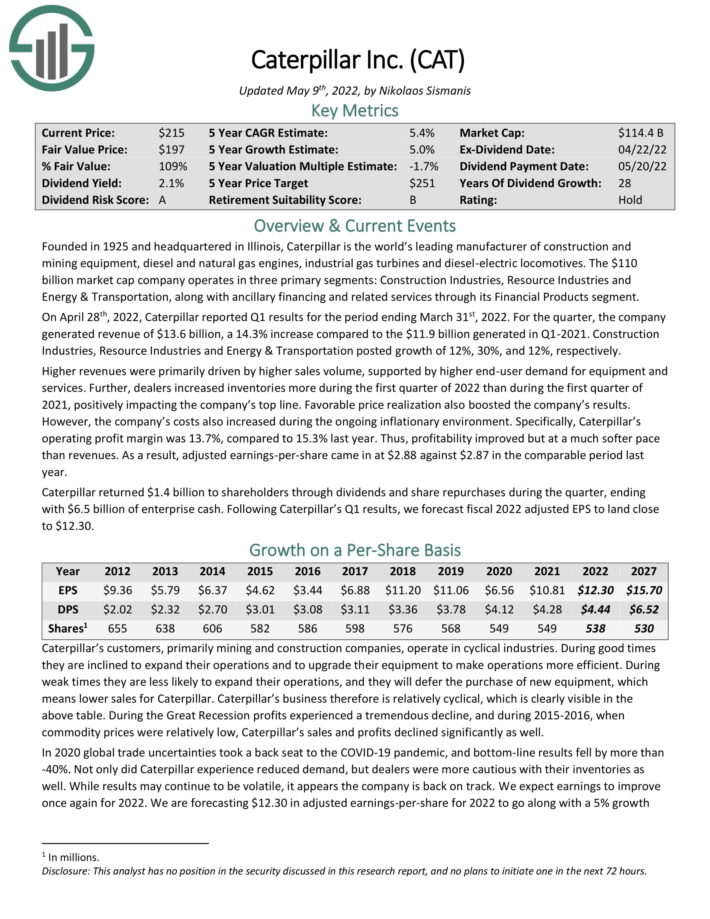

On April 28th, 2022, Caterpillar reported Q1 results for the period ending March 31st, 2022. For the quarter, the company generated revenue of $13.6 billion, a 14.3% increase compared to the $11.9 billion generated in Q1-2021. Construction Industries, Resource Industries and Energy & Transportation posted growth of 12%, 30%, and 12%, respectively.

Higher revenues were primarily driven by higher sales volume, supported by higher end-user demand for equipment and services. Further, dealers increased inventories more during the first quarter of 2022 than during the first quarter of 2021, positively impacting the company’s top line. Favorable price realization also boosted the company’s results.

However, the company’s costs also increased during the ongoing inflationary environment. Specifically, Caterpillar’s operating profit margin was 13.7%, compared to 15.3% last year. Thus, profitability improved but at a much softer pace than revenues. As a result, adjusted earnings-per-share came in at $2.88 against $2.87 in the comparable period last year.

Click here to download our most recent Sure Analysis report on Caterpillar (preview of page 1 of 3 shown below):

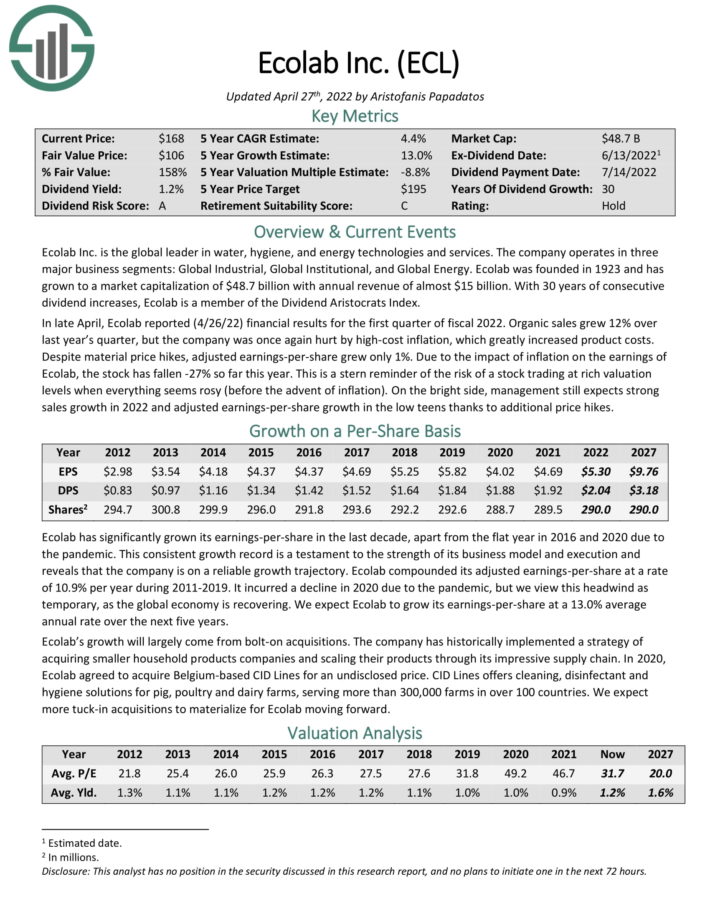

#5—Ecolab

Dividend Yield: 1.2%

Percentage of Bill Gates’ Portfolio: 3.9%

Ecolab was created in 1923, when its founder Merritt J. Osborn invented a new cleaning product called “Absorbit”. This product cleaned carpets without the need for businesses to shut down operations to conduct carpet cleaning. Osborn created a company revolving around the product, called Economics Laboratory, or Ecolab.

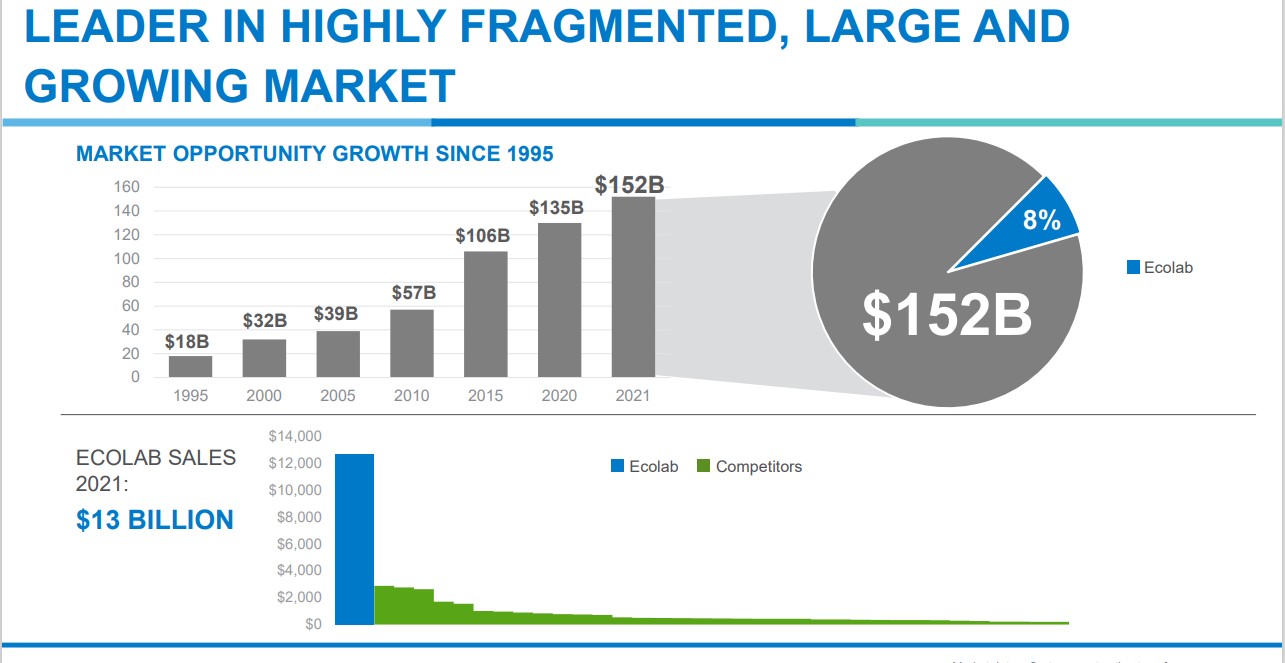

Source: Investor Presentation

Today, Ecolab is the industry leader and generates annual sales of roughly $13 billion. Ecolab operates three major business segments: Global Industrial, Global Institutional, and Global Energy, each of roughly equal size. The business is diversified in terms of operating segments, and also geography.

In late April, Ecolab reported (4/26/22) financial results for the first quarter of fiscal 2022. Organic sales grew 12% over last year’s quarter, but the company was once again hurt by high-cost inflation, which greatly increased product costs. Despite material price hikes, adjusted earnings-per-share grew only 1%.

On the bright side, management still expects strong sales growth in 2022 and adjusted earnings-per-share growth in the low teens thanks to additional price hikes.

Click here to download our most recent Sure Analysis report on Ecolab (preview of page 1 of 3 shown below):

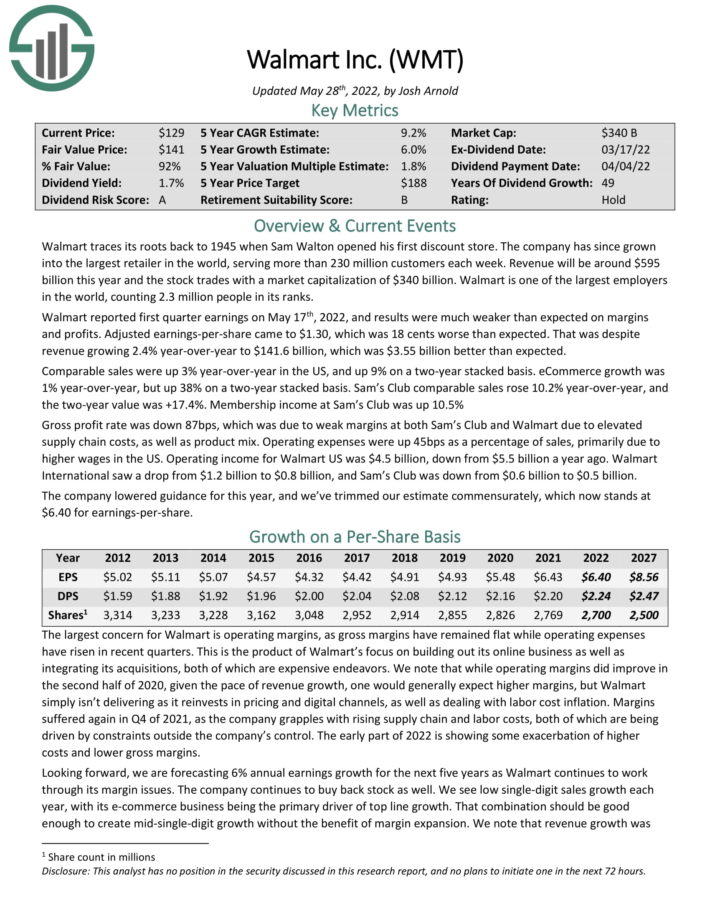

#6—Walmart Inc.

Dividend Yield: 1.7%

Percentage of Bill Gates’ Portfolio: 2.28%

Walmart is another great example of a company with durable competitive advantages. It is the largest retailer in the U.S., with annual revenue above $600 billion. The company came to dominate the retail industry by keeping a laser-like focus on reducing costs everywhere, particularly in supply chain and distribution.

Consumers tend to scale down to discount retail when times are tight, which is why Walmart continued to grow, even during the Great Recession. As a result, Walmart is arguably the most recession-resistant stock in the Gates Foundation’s portfolio.

This allows Walmart the ability to raise its dividend each year like clockwork, even during recessions. Walmart has raised its dividend for over 40 years in a row.

Its long history of dividend growth qualifies Walmart as a Dividend Aristocrat, a group of companies in the S&P 500 that have raised dividends for at least 25 consecutive years.

Click here to download our most recent Sure Analysis report on Walmart (preview of page 1 of 3 shown below):

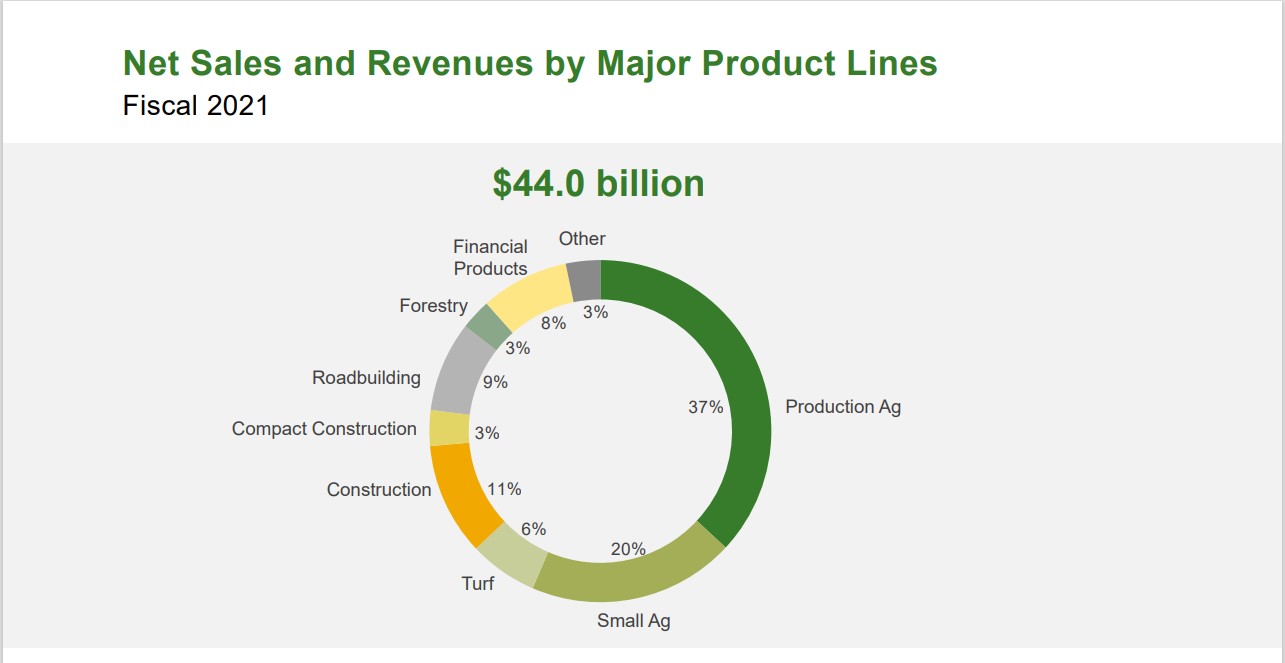

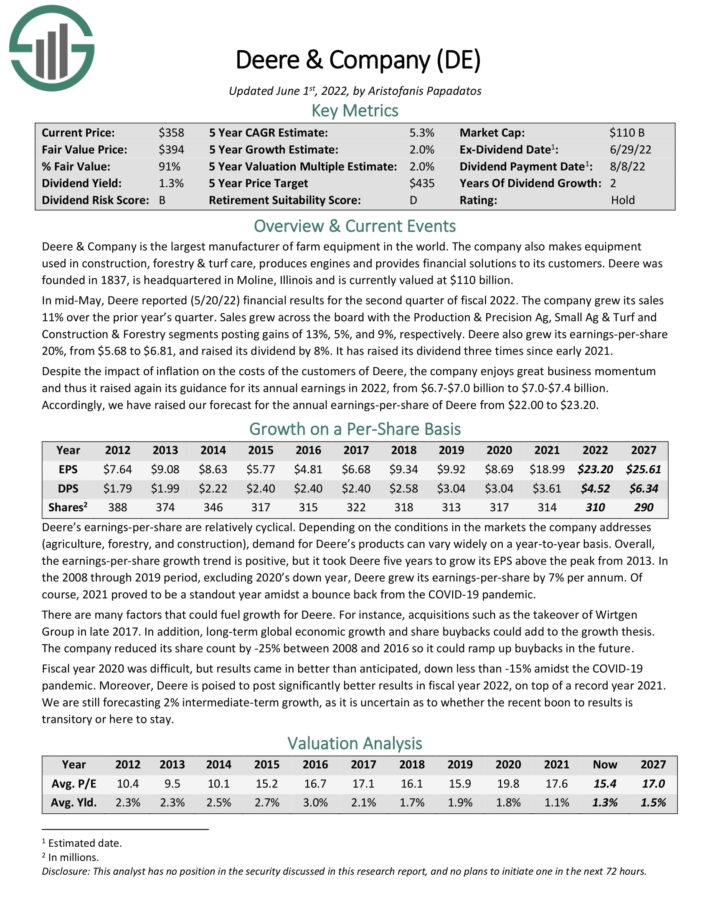

#7—Deere & Company (DE)

Dividend Yield: 1.3%

Percentage of Bill Gates’ Portfolio: 1.89%

Deere & Company is the largest manufacturer of farm equipment in the world. The company also makes equipment used in construction, forestry & turf care, produces engines and provides financial solutions to its customers. Deere was founded in 1837.

Source: Investor Presentation

In mid-May, Deere reported (5/20/22) financial results for the second quarter of fiscal 2022. The company grew its sales 11% over the prior year’s quarter. Sales grew across the board with the Production & Precision Ag, Small Ag & Turf and Construction & Forestry segments posting gains of 13%, 5%, and 9%, respectively. Deere also grew its earnings-per-share 20%, from $5.68 to $6.81, and raised its dividend by 8%. It has raised its dividend three times since early 2021.

Despite the impact of inflation on the costs of the customers of Deere, the company enjoys great business momentum and thus it raised again its guidance for its annual earnings in 2022, from $6.7-$7.0 billion to $7.0-$7.4 billion. Accordingly, we have raised our forecast for the annual earnings-per-share of Deere from $22.00 to $23.20.

Click here to download our most recent Sure Analysis report on Deere (preview of page 1 of 3 shown below):

#8—Coca-Cola FEMSA SAB

Dividend Yield: 4.7%

Percentage of Bill Gates’ Portfolio: 1.73%

Coca-Cola FEMSA produces, markets, and distributes Coca-Cola (KO) beverages. It offers the full line of sparkling and still beverages. It sells its products through distribution centers and retailers in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina, and the Philippines.

Coca-Cola FEMSA is the largest franchise bottler in the world. The stock is an excellent way to gain exposure to two very attractive emerging markets: Latin America and South Asia.

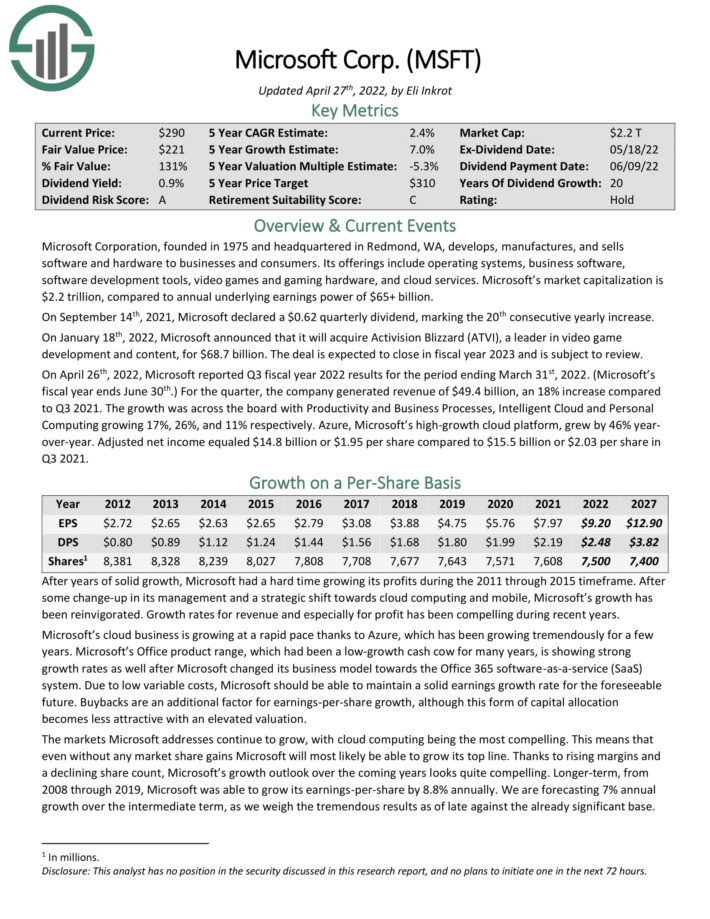

#9—Microsoft

Dividend Yield: 0.7%

Percentage of Bill Gates’ Portfolio: 1.47%

Microsoft Corporation, founded in 1975 and headquartered in Redmond, WA, develops, manufactures and sells both software and hardware to businesses and consumers.

Its offerings include operating systems, business software, software development tools, video games and gaming hardware, and cloud services.

On April 26th, 2022, Microsoft reported Q3 fiscal year 2022 results for the period ending March 31st, 2022. (Microsoft’s fiscal year ends June 30th.) For the quarter, the company generated revenue of $49.4 billion, an 18% increase compared to Q3 2021. The growth was across the board with Productivity and Business Processes, Intelligent Cloud and Personal Computing growing 17%, 26%, and 11% respectively.

Azure, Microsoft’s high-growth cloud platform, grew by 46% year-over-year. Adjusted net income equaled $14.8 billion or $1.95 per share compared to $15.5 billion or $2.03 per share in Q3 2021.

Click here to download our most recent Sure Analysis report on Microsoft (preview of page 1 of 3 shown below):

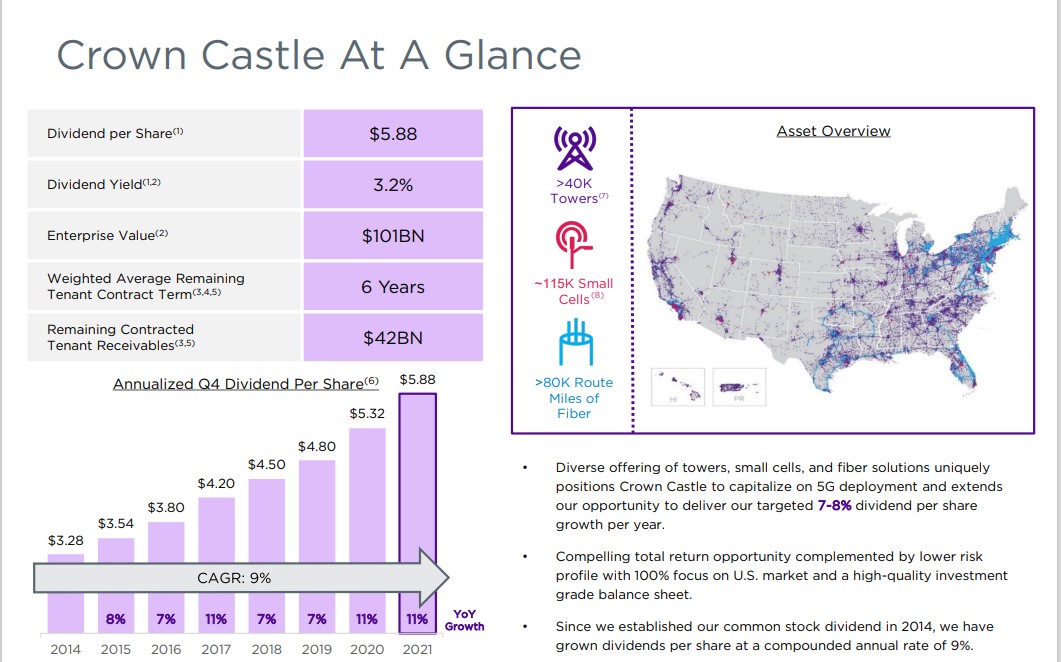

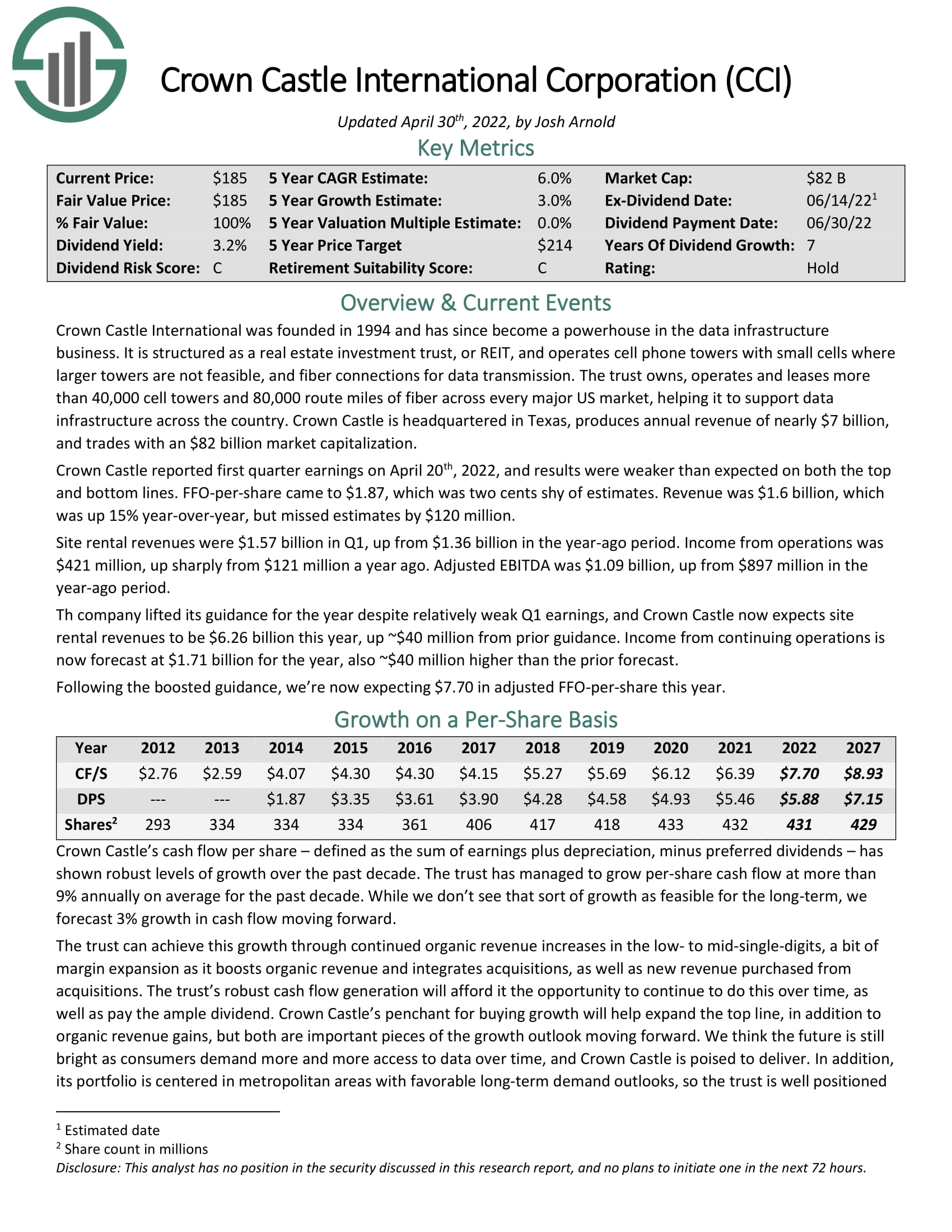

#10—Crown Castle International

Dividend Yield: 3.3%

Percentage of Bill Gates’ Portfolio: 1.33%

Crown Castle International is structured as a real estate investment trust, or REIT. You can see our full REIT list here.

Crown Castle owns cell phone towers with small cells where larger towers are not feasible, and fiber connections for data transmission. The trust owns, operates and leases more than 40,000 cell towers and 75,000 route miles of fiber across every major US market, helping it to support data infrastructure across the country.

Source: Investor Presentation

Crown Castle reported first quarter earnings on April 20th, 2022, and results were weaker than expected on both the top and bottom lines. FFO-per-share came to $1.87, which was two cents shy of estimates. Revenue was $1.6 billion, which was up 15% year-over-year, but missed estimates by $120 million.

Site rental revenues were $1.57 billion in Q1, up from $1.36 billion in the year-ago period. Income from operations was $421 million, up sharply from $121 million a year ago. Adjusted EBITDA was $1.09 billion, up from $897 million in the year-ago period.

The company lifted its guidance for the year despite relatively weak Q1 earnings, and Crown Castle now expects site rental revenues to be $6.26 billion this year, up ~$40 million from prior guidance. Income from continuing operations is now forecast at $1.71 billion for the year, also ~$40 million higher than the prior forecast.

Click here to download our most recent Sure Analysis report on Crown Castle International (preview of page 1 of 3 shown below):

#11—Schrodinger Inc.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 1.21%

Schrodinger, Inc. is a health care technology company. It operates a computational platform that aims to accelerate drug delivery, both for external clients and the company’s own internal drug programs. Schrodinger conducted its initial public offering in February 2020. The stock currently has a market capitalization above $2 billion.

Schrodinger has exciting growth potential, due to the success of its drug delivery platform and its large and diversified customer base.

Schrodinger has a long runway of growth, because of the high degree of value that its products and services provide to customers. Designing drugs is extremely difficult work which is complex, lengthy, capital-intensive, and prone to high failure rates. This means many customers will continue to outsource this work to Schrodinger.

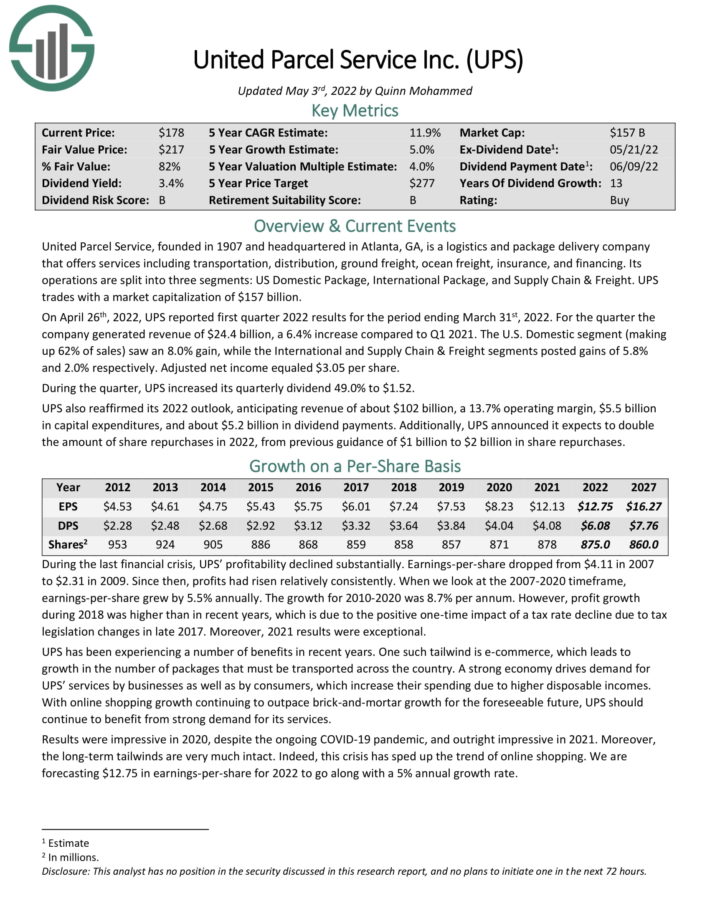

#12—United Parcel Service

Dividend Yield: 2.7%

Percentage of Bill Gates’ Portfolio: 0.80%

United Parcel Service is a logistics and package delivery company that offers services including transportation, distribution, ground freight, ocean freight, insurance and financing. Its operations are split into three segments: U.S. Domestic Package, International Package, and Supply Chain & Freight.

The company’s continued growth in the face of potential global economic headwinds, is due largely to its competitive advantages. UPS is the largest logistics/package delivery company in the U.S.

Source: Investor Presentation

It operates in a near duopoly, as its only major competitor to date is FedEx. To be sure, Amazon (AMZN) is expanding its own logistics business, but it still remains a customer of UPS as well.

On April 26th, 2022, UPS reported first quarter 2022 results for the period ending March 31st, 2022. For the quarter the company generated revenue of $24.4 billion, a 6.4% increase compared to Q1 2021. The U.S. Domestic segment (making up 62% of sales) saw an 8.0% gain, while the International and Supply Chain & Freight segments posted gains of 5.8% and 2.0% respectively. Adjusted net income equaled $3.05 per share.

During the quarter, UPS increased its quarterly dividend 49.0% to $1.52. UPS also reaffirmed its 2022 outlook, anticipating revenue of about $102 billion, a 13.7% operating margin, $5.5 billion in capital expenditures, and about $5.2 billion in dividend payments.

Click here to download our most recent Sure Analysis report on UPS (preview of page 1 of 3 shown below):

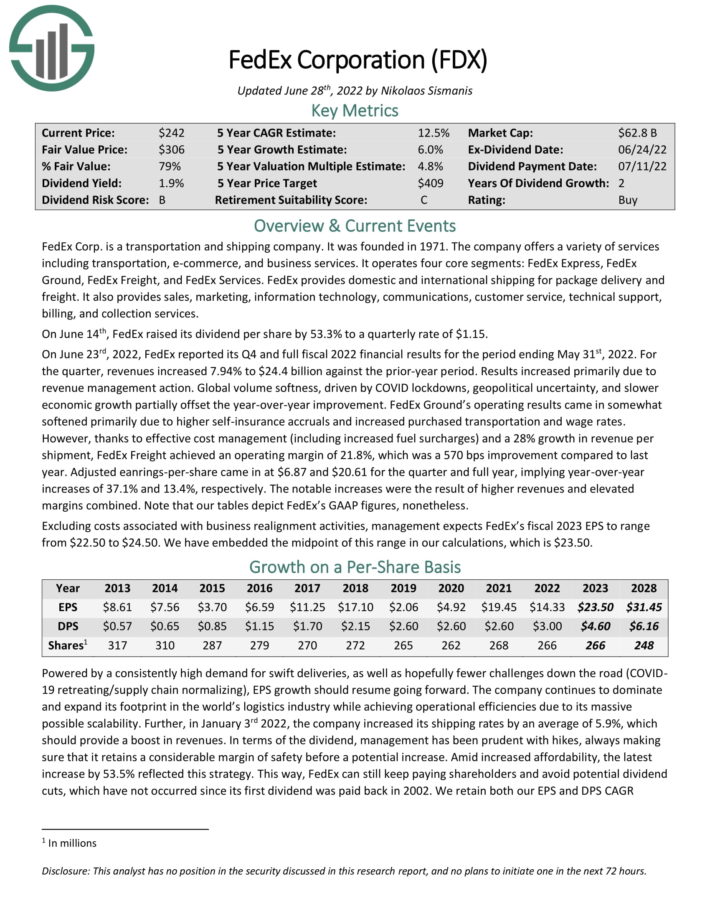

#13—FedEx

Dividend Yield: 1.5%

Percentage of Bill Gates’ Portfolio: 0.63%

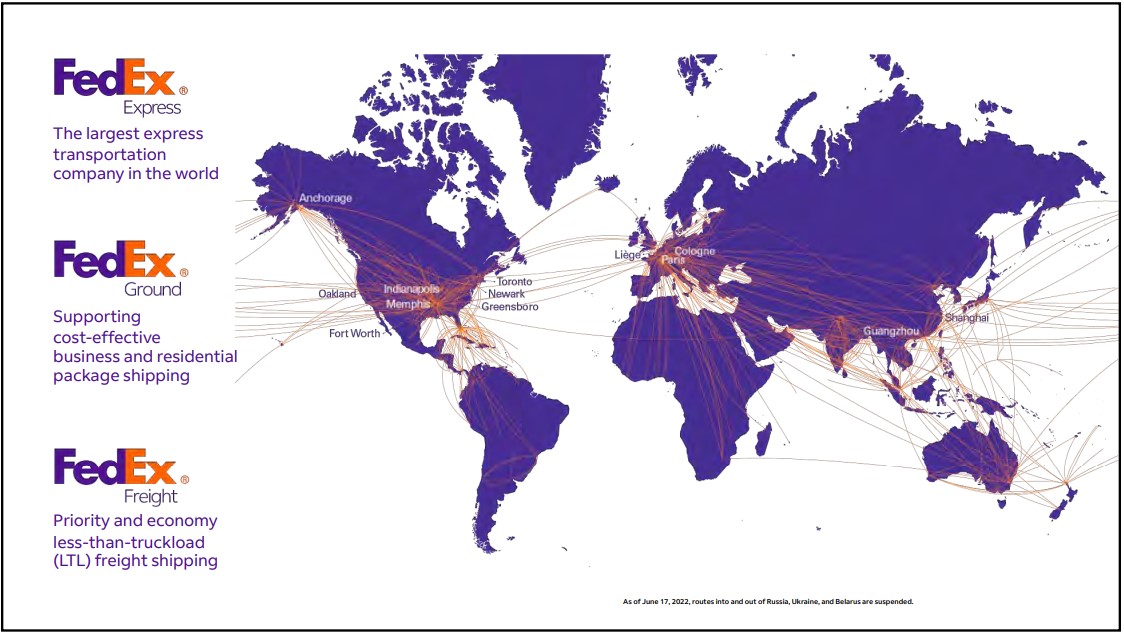

FedEx Corp. is a transportation and shipping company. The company offers a variety of services including transportation, e-commerce, and business services. It operates four core segments: FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services.

Source: Investor Presentation

On June 14th, FedEx raised its dividend per share by 53.3% to a quarterly rate of $1.15.

On June 23rd, 2022, FedEx reported its Q4 and full fiscal 2022 financial results for the period ending May 31st, 2022. For the quarter, revenues increased 7.94% to $24.4 billion against the prior-year period. Results increased primarily due to revenue management action. Global volume softness, driven by COVID lockdowns, geopolitical uncertainty, and slower economic growth partially offset the year-over-year improvement.

FedEx Ground’s operating results came in somewhat softened primarily due to higher self-insurance accruals and increased purchased transportation and wage rates. However, thanks to effective cost management (including increased fuel surcharges) and a 28% growth in revenue per shipment, FedEx Freight achieved an operating margin of 21.8%, which was a 570 bps improvement compared to last year.

Adjusted earnings-per-share came in at $6.87 and $20.61 for the quarter and full year, implying year-over-year increases of 37.1% and 13.4%, respectively. Excluding costs associated with business realignment activities, management expects FedEx’s fiscal 2023 EPS to range from $22.50 to $24.50.

Click here to download our most recent Sure Analysis report on FedEx (preview of page 1 of 3 shown below):

#14—Coupang, Inc.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.51%

Coupang is an e-commerce platform through its mobile apps and websites primarily in South Korea. It sells various products and services in the categories of home goods, apparel, beauty products, fresh food and groceries, sporting goods, electronics, consumables, and more.

#15—Sanderson Farms, Inc.

Dividend Yield: 0.8%

Percentage of Bill Gates’ Portfolio: 0.50%

an integrated poultry processing company, produces, processes, markets, and distributes fresh, frozen, and prepared chicken products in the United States. The company sells ice-packed, chill-packed, bulk-packed, and frozen chicken primarily under the Sanderson Farms brand name to retailers, distributors, and casual dining operators in the United States.

#16—Madison Square Garden Sports Corp.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.25%

Madison Square Garden Sports Corp. is a diversified sports company. It owns multiple sports franchises including the New York Knicks and the New York Rangers. It also owns development league teams such as the Hartford Wolf Pack and the Westchester Knicks of the NBA G League. It also owns e-sports properties including Knicks Gaming and a controlling interest in Counter Logic Gaming (CLG).

#17—Weber Inc.

Dividend Yield: 1.0%

Percentage of Bill Gates’ Portfolio: 0.12%

Weber manufactures and distributes outdoor cooking products, accessories, consumables, and services in the U.S. and internationally. Its products include charcoal and gas grills, smokers, pellet and electric grills, and more.

#18—On Holding AG

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.06%

On Holding is based in Switzerland and it develops and distributes sports products worldwide. It offers its products through independent retailers and distributors, online, and stores.

This article was first published by Bob Ciura for Sure Dividend.

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.