The Kenya Revenue Authority (KRA) has over the years been keen at broadening and cementing its tax base.

In order to achieve this, KRA has introduced a string of measures aimed at increasing the amount of revenue government rakes in from different sectors of the economy.

READ ALSO: Filing Tax Returns: Good news for taxpayers as KRA extends working hours

KRA has several measures in place to increase the amount of revenue government rakes in from different sectors of the economy. Photo: KRA

Source: UGC

READ ALSO: Step by step guide of filing income tax, nil returns on new iTax portal

The going has, nonetheless, not been easy considering the fact that previous regimes were punctuated by revenue leakage among other bottlenecks.

The following are among measures KRA has put in place to improve compliance:

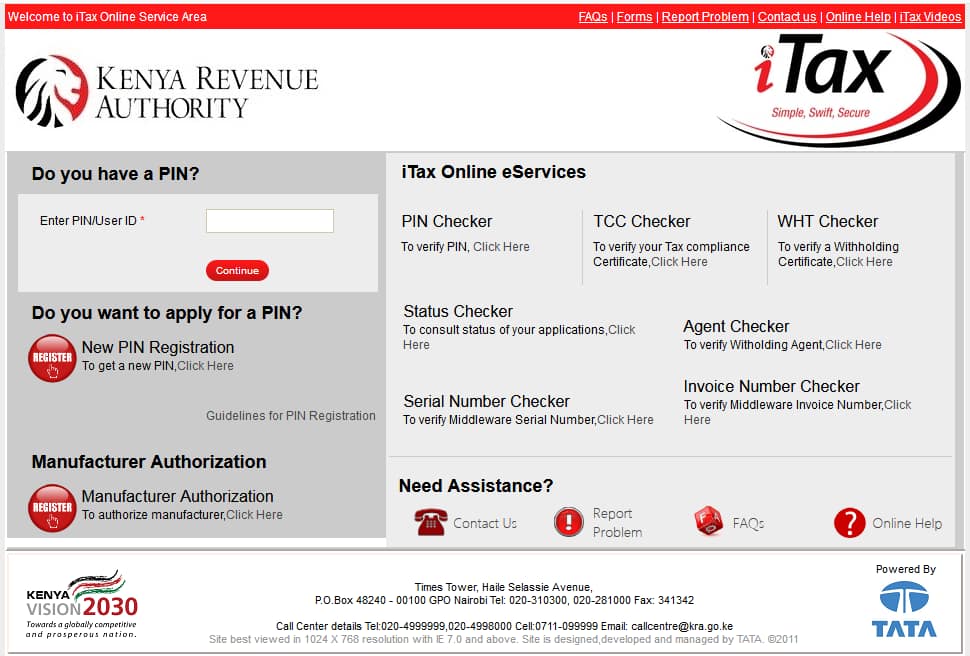

1. iTax

This is is a web-enabled and secure application system that provides taxpayers with a fully-integrated and automated solutions for every matter relating to domestic taxes.

It was launched in 2013, and has turned out to be a hallmark in Kenya’s revenue collection and accounting history.

This platform enables taxpayers to register for a KRA PIN, file returns, get Tax Compliant Certificates and also provide real time monitoring of taxpayer’s accounts.

Before it was rolled out, Kenyans had to travel to KRA offices to to address all tax issues. This was tedious and discouraged taxpayers.

Now with over 6.7 million users, iTax has eliminated major bottlenecks that taxpayers used to endure while interacting with KRA.

READ ALSO: 8 important reasons why you should file your tax returns before June 30

Tax has over 6.7 million users.It has eliminated major bottlenecks that taxpayers used to endure while interacting with KRA. Photo: KRA

Source: UGC

2. Automated Verification of VAT Returns (VAA)

This is among the latest technologies the taxman has incorporated in its systems. The VAA generates automated Value Added Tax {VAT) assessments through the iTax platform.

It identifies inconsistencies between purchase and sales invoices declared in VAT returns.

After this, it communicates the inconsistencies to both the buyer and the seller.

Afterwards, it raises an auto assessment on the buyer for any tax payable relating to the inconsistencies.

It envisions to curb claiming of fictitious and or unsupported input tax by VAT registered people and thereby bolstering compliance.

READ ALSO: KRA: What Kenyans want their taxes to do

3. One Stop Border Posts (OSBP)

In order to prevent loss of revenue from imports and exports at boarder points, KRA has established at least six OSBP.

These strategic offices are managed by Legal Administration of Customs and Border Control Department.

In Kenya, they exist in Lunga Lunga, Taveta, Namanga, Isebania, Malaba, Busia, and Moyale.

They take part in collecting and accounting for Import Duty and VAT on imports.

Another function of the OSBP is to compliment security agencies operations at the entry points. They are able to net tax evaders, substandard or contrabands and illegal goods.

5. Regional Cargo Tracking System (RECTS)

In East Africa region, Kenya has been singled out as a preferred cargo route. This due to its access to the Mombasa Port, other inland ports and enhanced road and air transport networks.

Earlier, the country was losing a lot of revenue to fraudsters who would escape paying taxes.

With the advent of satellite enabled RECTS, the taxman is able to trace each cargo and understand its contents remotely and at anytime.

The system enables real time tracking of transit cargo from the port of Mombasa to its final destination through an online digital platform. Photo: KRA

Source: UGC

6. iTax Service Centers

In a move to bring services closer to all taxpayers, KRA has established several physical hubs to enhance performance of iTax.

Some of the centers are available in Nairobi (Railways Club), Sameer Park , Kisumu (Swan Center), Garissa KRA Office, Mombasa (Forodha House), Nyeri (Premier House), Eldoret (Kiptangich House), Nakuru’s KRA office and Malindi Complex among other towns.

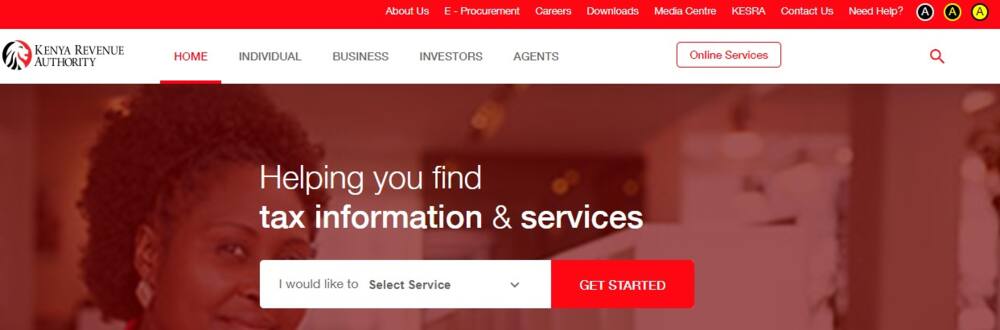

7. KRA Website

Apart from iTax, KRA also has its official website that is all under one roof shop for all taxpayer’s needs.

The website has been made easy to use and users can get information relevant to investors, businesses, tax payment, PIN application and also find recently published documents that can be downloaded.

It also serves as a perfect notice board as news, press releases and notices are shared on the same platform.

The website serves a perfect notice board as news, press releases and notices are shared on the same platform. Photo: KRA

Source: UGC

8. Enhanced Social Media Presence

In line with the government’s call for all agencies to embrace technology and convergence of information, KRA has invested in maintaining active presence on social media platforms.

Taxpayers can lodge queries, seek clarification from customer care staff by just contacting KRA via Facebook or Twitter.

Currently, a lot of interaction is being witnessed between the authority and taxpayers who seek to understand the process of filing returns.

{Sponsored}

Source: Tuko.co.ke